The engine sputters, but freight flows: A paradoxical opportunity for German Shippers amidst the slowdown

If you feel the ground shifting beneath your feet and find that strategic planning feels more like reading tea leaves, you're not alone.

The hard data from “Transport in Europe” report paints a picture of stagnation:

The hard data from “Transport in Europe” report paints a picture of stagnation:

-

Business sentiment in a slump: The Ifo Business Climate Index, a key barometer of German business sentiment, is barely crawling towards the 90-point mark, having failed to approach the threshold of optimism for months.

-

Anemic economic growth: Germany's GDP growth forecast for this year remains stagnant, with a mere 0.4% increase recorded in the second quarter.

-

Industry struggling for air: Despite a slight improvement, the Manufacturing PMI still stood at 49.1 points in July—below the 50-point line that separates expansion from contraction.

"Germany, the engine of the European automotive industry – will see only symbolic growth this year (approx. 0.2%), coupled with a contraction in the automotive sector. Passenger car registrations in the EU fell by 1.9% in the first half of the year, which has translated into lower transport volumes for metal components, forklifts, and other industrial products. – perfectly summarized by Marta Guttierez Buron, Planning, Logistics & Operations Manager at Betsaide"

It would seem the only viable strategy is to cut costs and wait for better times. But what if I told you that a unique, strategic opportunity lies hidden in the very heart of this slowdown? The paradox is that the problem isn't a lack of freight. Quite the opposite.

Export breakthrough: Where demand outstrips supply

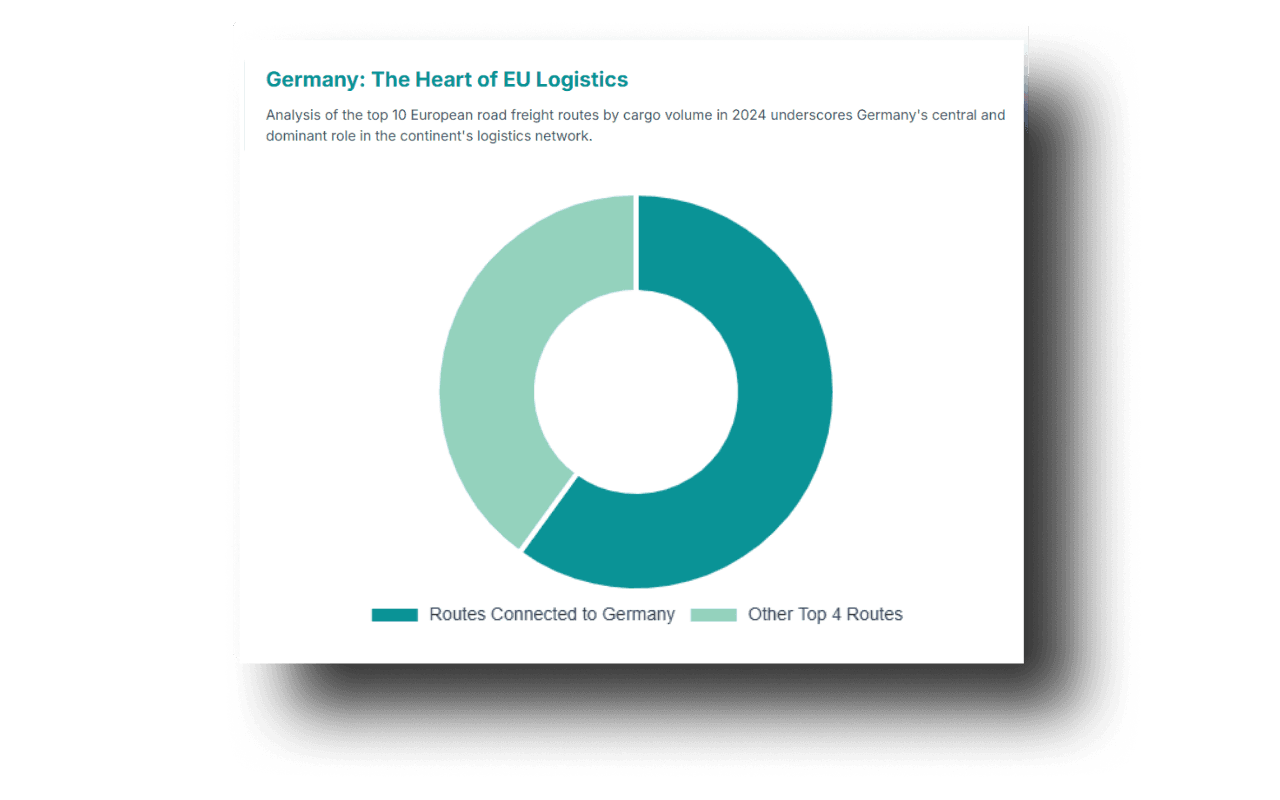

While the macroeconomic indicators are failing, data from the transport market tells a completely different story. German exports haven't just continued – they have exploded, generating massive, concentrated demand on key routes.

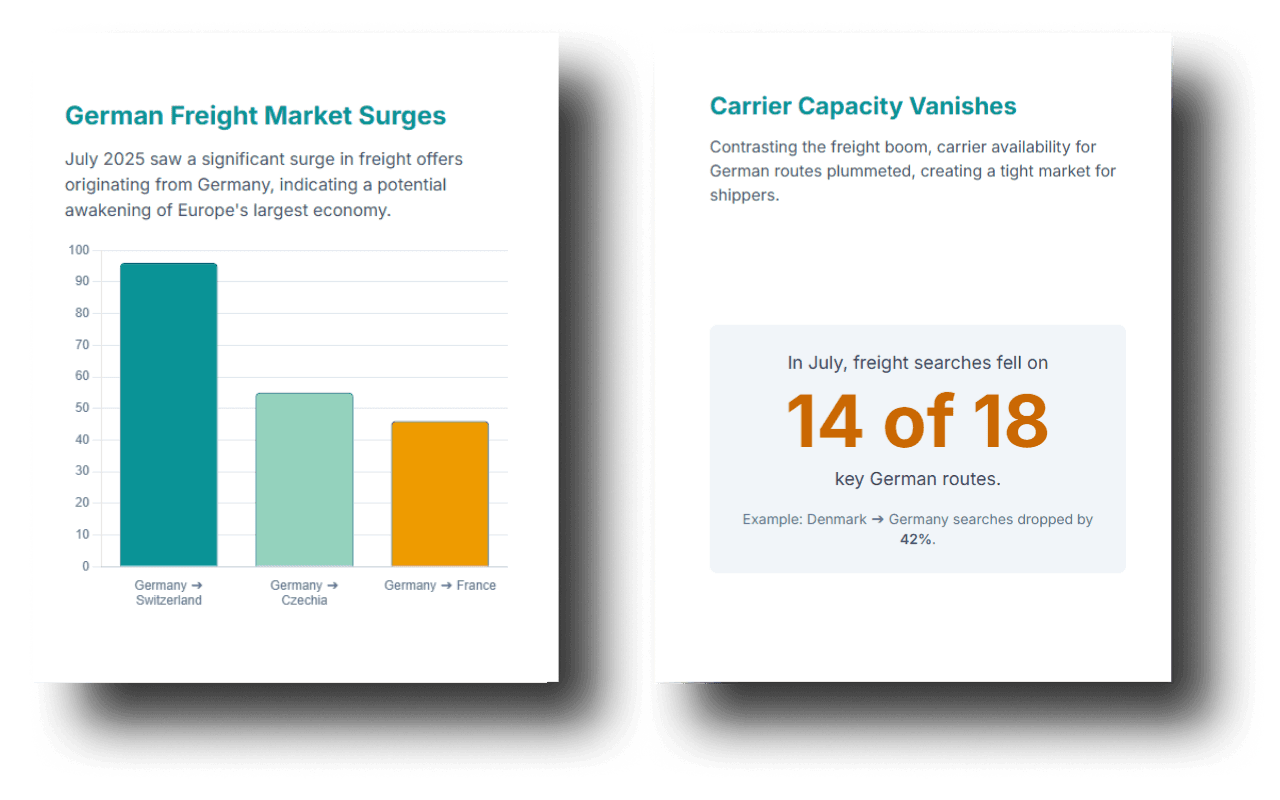

In July 2025, we witnessed a veritable avalanche of freight offers originating from Germany.

| DOWNLOAD FOR FREE |

The numbers speak for themselves:

-

Germany → Switzerland: a +96% year-on-year increase in freight offers.

-

Germany → Czech Republic: a +55% increase.

-

Germany → Belgium: a +52% increase.

-

Germany → France: a +46% increase.

-

Germany → Italy: a +45% increase.

These are not random fluctuations. This is a powerful signal that despite internal economic weakness, German goods remain highly sought-after across Europe. What explains this phenomenon?

"The sustained growth in freight offers from Germany to Switzerland and France stems from strong trade links and consistent demand in key sectors like automotive, chemicals, and pharmaceuticals. Limited transport capacity and a shortage of vehicles further intensify the upward pressure on prices. These lanes are less susceptible to seasonal fluctuations, which is why they record a stable upward trend throughout the year.” – clarifies in our report Karol Kupczak, Transport and Logistics Director at Flash Logistic.

And here lies the crux of the matter: the demand for transport is immense, but the supply... the supply is vanishing before our very eyes.

Strategic advantage in the face of a "Carrier Exodus"

The biggest challenge for German shippers in the coming months won't be finding customers, but securing carriers. The data is alarming, revealing a dramatic drop in available transport capacity on the very same routes where demand has exploded.

We call this phenomenon a "carrier exodus." Transport companies, discouraged by difficult operating conditions, rising costs, and low profitability, are simply bypassing the German market or limiting their activity there.

-

In June, the key Germany -> Italy route saw a staggering 20% year-on-year drop in freight searches by carriers.

-

In July, most routes to and from Germany experienced double-digit declines in carrier activity.

-

On the Denmark -> Germany route, this decline reached a dramatic 42% in July.

This imbalance – a surging number of loads and a disappearing pool of carriers willing to transport them – can have only one outcome: a sharp increase in rates. It's already happening. In July, freight prices on the Germany -> Denmark route soared by 20.3% year-on-year, and on ten other key routes, increases exceeded 10%.

Conclusion: It's Time for strategic partnerships, not a Price War

The winners will be the companies that understand this fundamental market shift. The era of hunting for the cheapest spot market deals is definitively over. Victory will belong to those who secure long-term contracts and build strategic, lasting partnerships with carriers, thereby guaranteeing access to dwindling resources.

"Declining volumes and shrinking transport capacity are creating a temporary market balance. In the coming months, I anticipate a severe lack of freight capacity and a significant increase in rates." – emphasizes dr Paweł Trębicki, Managing Director at Rhenus Road Freight - Central East Region.

This is the final call to shift from tactical cost-saving to strategically building supply chain security and stability. While your competitors are still focused on weak GDP figures, you can be securing the transport capacity that will be worth its weight in gold in a few months' time.

Key Takeaways for Leaders:

-

Stop looking only at macro indicators: The general health of the German economy does not reflect the immense demand for transport in key export niches.

-

Identify your "hot routes": Check which of your shipping lanes overlap with the routes experiencing the highest growth in freight offers (Switzerland, Czech Republic, France, Italy, Belgium).

-

Secure transport capacity now: Don't wait for the market to force your hand. Start negotiating fixed contracts and build relationships with trusted transport partners.

-

Think stability, not just price: In the current climate, a guarantee of transport availability is worth more than a temporary saving on a spot rate.

| DOWNLOAD FOR FREE |

Main graphic source: Google, Imagen AI Generated.