Contract rates have fallen - a warning or a correction to Europe's road transport market?

Contract index decline: what do the data say?

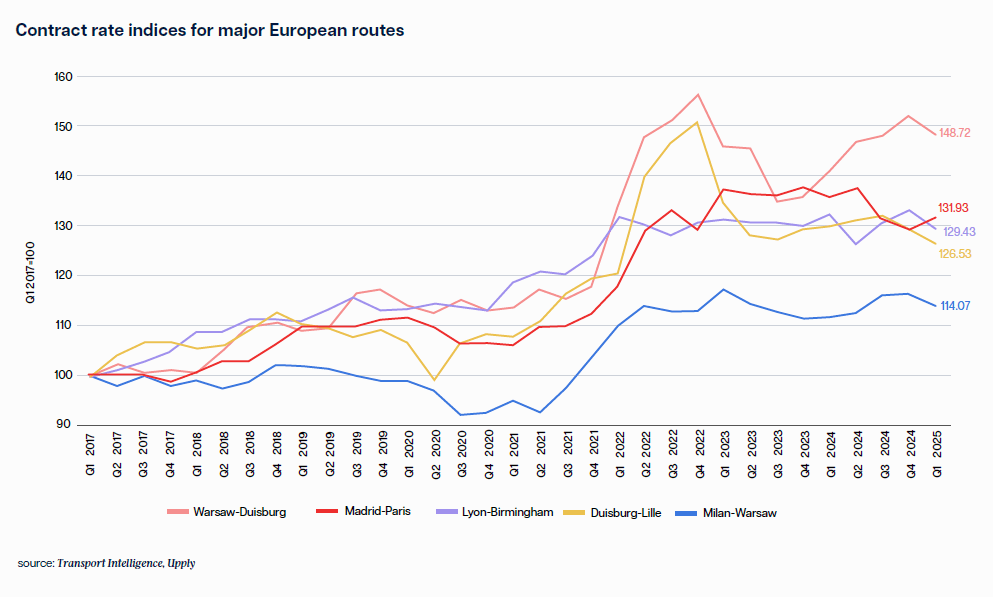

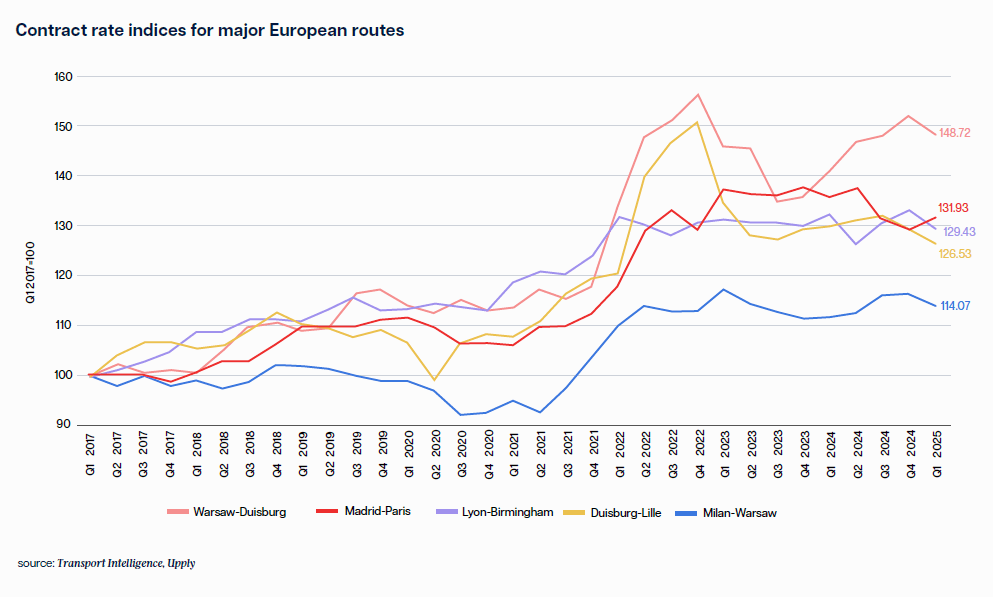

The contract rate index in Europe in Q1 2025 was 131.1 points - a decrease of 2.3 points compared to Q4 2024. Although there is a minimal year-on-year increase (+0.4 points), the quarterly dynamics indicate a weakening of cost pressures and a decrease in the incentive to contract on fixed terms. The primary reason for this turnaround continues low demand and declining operating costs - including fuel and driver wages in some European regions.

Experts at the "Transport in Europe report" note that this is the first such marked correction since Q3 2023. - and could signal deeper shifts in contracting mechanisms.

Marie-Anne Cervoni, Associate Director Strategy, Market and Intelligence at IRU, points out that despite this temporary equalization, spot rates still remain higher than contract rates. According to her, this disparity reflects the lack of rolling stock availability and the limited flexibility of carriers toward ad hoc orders. She also points to the systemic problem of shrinking fleet manpower - particularly in Poland and Germany - which makes it even more difficult to stabilize the market.

In this context, it is worth analyzing how the current situation affects carriers' strategies. Companies need to assess whether it will be more profitable for them to conclude new contracts or wait for the market to stabilize. Such decisions should be based on reliable data and analysis - including market indicators, as presented in the report "Transport in Europe. Data. Trends. Analyses."

Destinations with a different potential [infographic]

An analysis of five major European routes shows that the decline was not uniform. Only one route - Madrid-Paris - recorded a quarter-on-quarter increase in the contract rate (+2.5%), which may be due to local cost increases or a temporary shortage of available carriers. The remaining routes recorded decreases:

- Warsaw-Duisburg: -2.3% k/k (but +5% y/y)

- Duisburg-Lille: -2.4% q/q

- Lyon-Birmingham: -3.3% q/q

- Milan-Warsaw: -1.75% q/q

It is the routes associated with Poland that have seen the greatest resilience to the downturn - they continue to record increases on an annual basis. This is confirmed by Ivan Bassan, Commercial Director at Discordia, who points out that despite quarterly declines, the market is still characterized by a shortage of rolling stock availability. What's more, the contract rejection rate is rising, indicating the difficulty for carriers to secure orders even with previously agreed terms.

In this situation, he believes, a rational approach is to secure part of the fleet (e.g. 30%) for stable contracts, and allow the rest to be reactive in the spot market. This approach allows for greater flexibility and revenue stabilization.

The results of this analysis help companies better understand which routes in Europe currently offer growth potential, and which are at risk of further decline in profitability.

Contracts as a market shock absorber?

Contracts as a market shock absorber? In an era of geopolitical obscurity and macroeconomic turmoil, many carriers are treating contracts as an element to cushion the impact of seasonality and declines in demand.

Olivier Gonon, Director Capacity Management as well as Procurement at Sennder, notes that as of September 2024 (with the exception of February and March 2025), spot rates remain higher than contract rates. He explains this by the lack of additional fleet availability for ad hoc orders and the fact that carriers are increasingly rejecting contract orders, not seeing them as profitable. In addition, each seasonal peak - such as vacations or the end of the year - generates price pressure.

According to Gonon, despite falling fuel costs, contract rates will remain high or even increase slightly. Moreover, he predicts that seasonal fluctuations in the spot market will continue, with the number of available vehicles continuing to decline due to limited new truck registrations, company bankruptcies and driver shortages.

How to ensure stability in transportation?

Similar conclusions are drawn from the observations of Fabian Szmurlo, Domestic FTL Product Director at Rohlig Suus Logistics. From his perspective, it is becoming crucial for freight companies today to partner with a logistics operator that can ensure stability despite market turbulence.

Szmurło points out that only a large and financially stable partner is able to ensure regular revenue. In times of recession, when there is an oversupply of cars, spot rates often fall below contract levels, which can sink smaller companies. Contracts, due to their predictability, allow better investment planning and smoother passage through downturns. In the face of a possible U.S. tariff war and a slowdown in the German economy - which could hit Poland with a ricochet - revenue forecasting is becoming a strategic currency.

For companies planning to grow their fleets, expand into new markets or enter tenders, this type of analysis may prove essential for making informed decisions in the second half of the year.

Poland compared to Europe: stabilization with potential

The data collected in the PITD report shows that Poland - despite the pan-European correction - still maintains its position as a stable logistics partner. Routes associated with our country not only do not deepen declines, but continue to record positive dynamics on an annual basis. This is a result of, among other things, Poland's growing importance as a manufacturing and logistics hub, but also structural challenges, such as the declining availability of professional drivers and cost pressures from EU regulations.

The report also shows that the ability to flexibly manage the order portfolio will be key in the coming months. The balancing of spot and contract market share may determine the profitability of carriers - especially medium-sized ones.

Read more in the report "Transport in Europe. Trends. Data. Analysis"

-

Complete index analysis for 20 European routes

-

Detailed y/y and k/k comparisons in euros/km

-

Conclusions and recommendations for carriers, shippers and principals

-

Scenarios for Q2 and Q3 2025.

-

Expert opinions from key markets: Germany, Poland, France, Italy, the Benelux

Interested in learning more? Download the free report from HERE

This is not marketing material. It's operations -focused material for decision makers who want to make informed decisions in a volatile environment.

Main graphic source: Midjourney